Bond issue impacts each taxpayer differently

Editor’s note: This is the last installment of a three-week series on the Randolph Public Schools’ bond issue on the general election ballot.

***

Trisha Benton Randolph Times

RANDOLPH – Does the Randolph Public Schools bond issue make “cents?”

For each taxpayer, the answer will vary and school district patrons are encouraged to use the bond tax calculators at www.randolphbuildstomorrow. org, to figure individual financial impact.

In total, the proposed $9.75 million bond provides for nearly $4.9 million upgrades at the elementary, $4.2 million for a new Career Technical Education (CTE) building; and almost $650,000 for updates to the high school building.

The bond issue comes about after the Randolph School Board studied facility needs - particularly a new ag building for CTE - for years. A facility audit last year provided more insight into the conditions at the elementary and high school buildings. In February, board members began working with a steering committee to whittle down more than 40 priority items to the current $9.75 million bond issue proposal with the hopes the amount would be something the community could support.

“We were careful to keep the costs as low as possible and still fund the needs,” said Board President Paul Schmit.

State legislation limits schools budget growth by 3 percent so facility needs can’t be financed by a regular levy. The school board looked at other funding options but ultimately decided a bond fit the district’s needs best.

If voters approve the bond, its associated levy is projected to be about 10.5 cents per $100 of taxable valuation, based on current valuations and an estimated borrowing rate of 4.3 percent. The projected levy includes principal and interest that would be calculated for the 20-year life of the bond.

Randolph Public Schools district valuations include portions of Cedar, Wayne and Pierce counties.

The borrowing rate will be locked in for the life of the loan unless the board decides to recall the bond and refinance it at a lower rate which is an option available every five years, said Superintendent Daryl Schrunk.

For the purposes of the bond, agriculture land is assessed at 50 percent of market value, per state law.

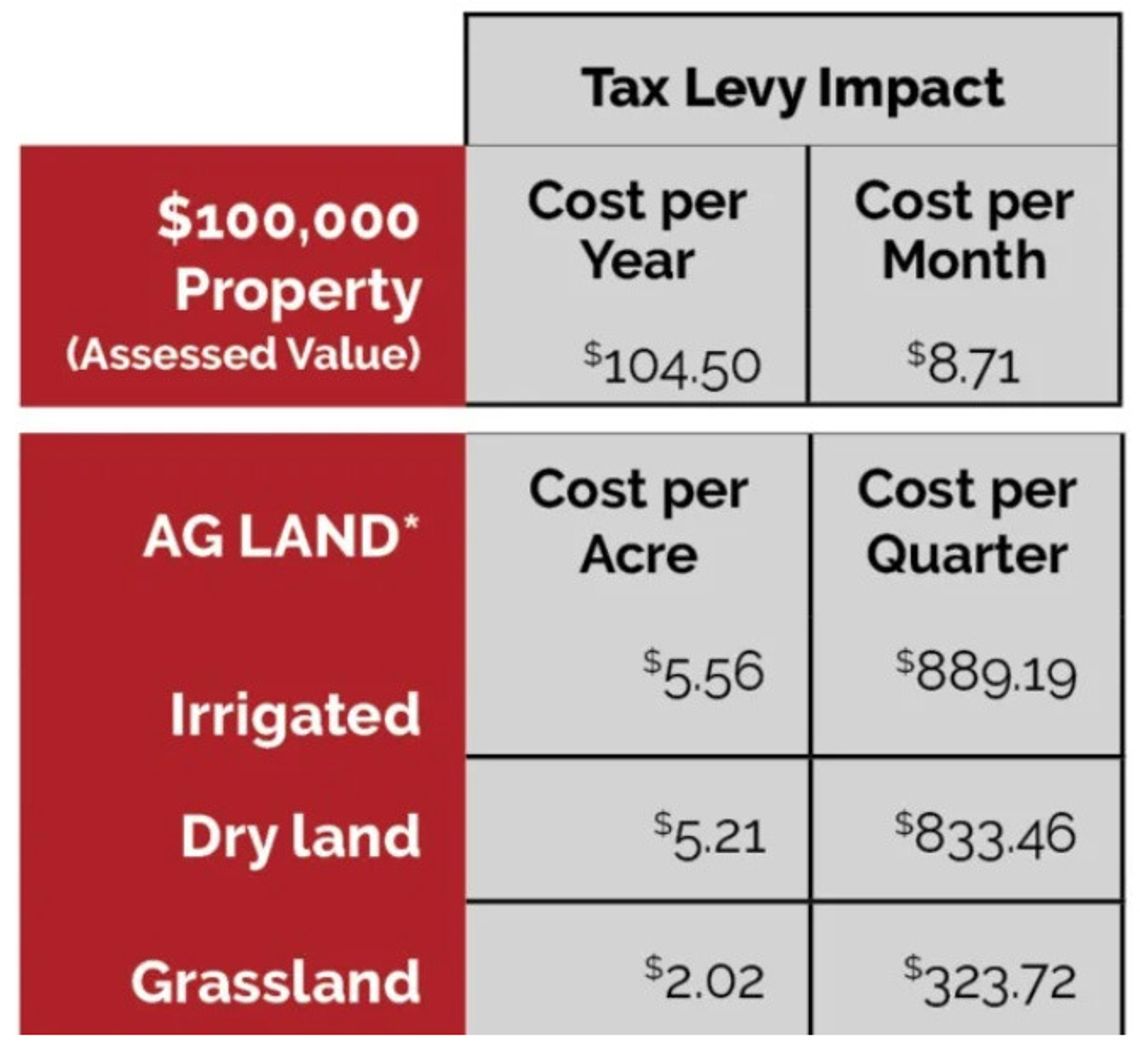

For example a property assessed at $100,000, would see taxes increase by $8.71 per month or $104.50 per year. For ag land, grassland cost per acre would increase $2.02, dry land, $5.21 and irrigated, $5.56.

“Most people want to know how much more yearly that they will pay,” Schrunk said of the tax calculator available on the website.

Just like regular levies, the bond levy can vary from year to year depending on valuations.

However, the same annual payment will be made.

Schrunk estimates the annual bond payment to be about $750,000.

The bond levy will be added to the Randolph Public School’s general fund levy to cover its regular expenditures. For the 2024-25 fiscal year, the regular tax levy was set at 38 cents.

If the bond passes, an estimated additional 10.5 cents would be added, boosting the overall levy to 48.5 cents, using 2024-25 budget numbers as an example.

The first impact to taxpayers would be figured into the school district’s 2025-26 fiscal year budget. Most likely, the impact wouldn’t be felt until January 2026, Schrunk said.

Historically, Randolph Public Schools’ tax levy is the lowest among public schools in the area. In some instances, area schools’ levies are more than double that of Randolph’s.

Even with the addition of the proposed bond levy, Randolph Public Schools levy would remain in the same position in comparison with other area schools in its tax request per pupil, Schrunk said.

“The value of the district being large does help a lot but when you look at what we do with your tax dollars; we do a pretty good job,” Board Member Lucas Miller said.

Property tax relief addressed in this year’s special session of the Nebraska Legislature will automatically provide a 30 percent tax credit of school district taxes through each taxpayer’s statement instead of having to claim it as a refundable income tax credit. Under the previous law, only 45 percent of Nebraskans were claiming the available property tax credit.

Voters passed a school bond of $3 million in 1994 to pay for the high school main gym, kitchen, commons, restrooms, offices, library, and four upper classrooms and hallway.

There was also a bond issue passed in 1964, although Schrunk was not aware of the total amount or what was included. It was around this time that the current ag building was built.

The 1994 bond was paid off about 18 months early, Schrunk said.

If the current bond issue fails at the polls, the school district’s facility needs don’t disappear, and costs will likely increase, Schrunk said.

Administrators and the board will listen to further feedback, and reassess.

The board will have to wait at least six months before trying to pass another bond.

For additional information on the proposed school bond, visit randolphbuildstomorrow.org.

.jpg)